The degree of revenue visibility Splunk has with this level of ARR is also impressive.

SPLUNK INVESTOR RELATIONS SOFTWARE

Heavy backend data projects like Splunk tend to get pushed down the priorities totem pole amid macro uncertainty, but what has ailed many other infrastructure software companies has seemingly not impacted Splunk at all. ARR in Q2 grew at a stunning 50% y/y pace of $1.93 billion, barely decelerating from Q1's growth rate in spite of the coronavirus. So the best measure of Splunk's growth, in my view, is its ARR. So ironically, the better that Splunk does in the cloud, the more its near-term revenue will suffer.

Under the old license-based model, Splunk would recognize a lot of its revenue upfront - but revenue would be lumpier, and over a customer's lifetime, switching to a recurring or cloud-based model will deliver more overall value. However, as seasoned Splunk investors are aware, Splunk's headline revenue figures form an incomplete story because of the transformational shift to cloud happening underneath. Splunk's revenue declined -5% y/y to $491.7 million in Q2, missing Wall Street's expectations of $520.4 million (or flat y/y) in the quarter. Splunk Q2 results Source: Splunk Q2 earnings release The Q2 earnings summary is shown below:įigure 1. Let's now parse through Splunk's latest quarterly results in greater detail. Investors should take note of Splunk's myriad strengths and stay long. Cloud margins have been rising as it becomes a greater contributor to overall revenue, and Splunk has a target of hitting >$1 billion in annual operating cash flows by FY23 (two and a half years out).

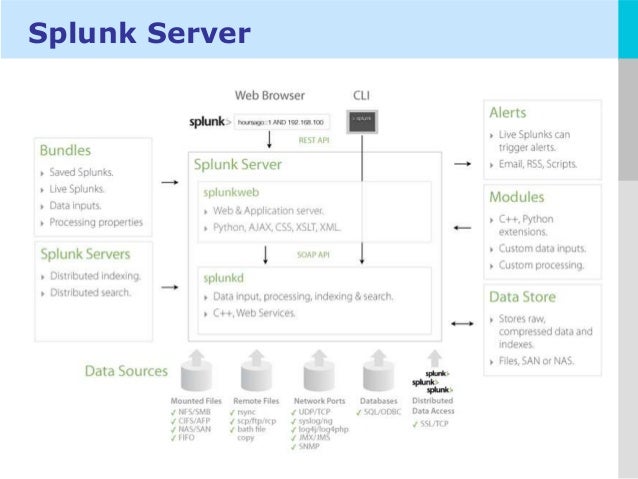

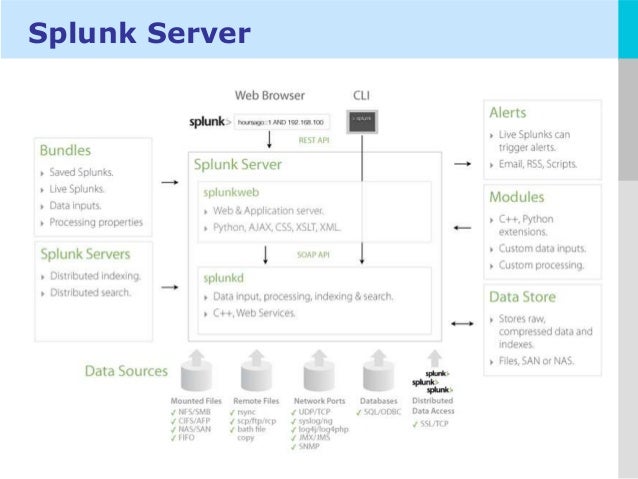

Managing the business with profitability in mind. Since announcing its determination to shift its business to the cloud, Splunk has been growing ARR at ~50% y/y despite a ~$2 billion ARR scale Splunk focuses on visualizing and analyzing machine data (information passively generated by computers, phones, and other endpoints within networks). The company's closest large/public peers are the monitoring companies like Datadog ( DDOG) and New Relic ( NEWR), which primarily focus on monitoring the performance and uptime of applications and infrastructure. Splunk isn't without competitors, but the company's focus on machine data is unique. But as Splunk has evolved, the company's machine data capabilities are applicable across virtually any industry and across many functions. In its early days, Splunk's machine data-mining capabilities were often used for security purposes to flag and respond to anomalies within corporate systems. The use cases for Splunk are infinite. The key points of the bullish thesis that investors should be aware of for Splunk: Splunk is one of them, thanks to the sheer size of the market opportunity ahead of it (the company estimated its TAM at $62 billion a year ago) and the speed at which it is growing a recurring business to fill that market. I can think of very few software companies that I'm comfortable holding through the long term even as they see tremendous multiples expansion and no longer offer a reasonable value angle. Shares of Splunk are already up ~45% year-to-date (though flat after a strong Q2), but I think there's still plenty of upside in this stock: Data by YCharts The machine data company - which essentially processes data generated by a company's internal systems and transforms them into actionable insights for senior corporate executives - has been growing like a weed despite its scale, and is finding tremendous success in converting its previously license-based software model into the recurring/SaaS subscription business model that investors particularly love at the moment. To the everyday consumer, the name Splunk ( NASDAQ: SPLK) may not mean much, but within enterprise software, Splunk has become a transformational company amassing users in virtually every industry.

0 kommentar(er)

0 kommentar(er)